The beauty industry is changing, expanding at a rapid rate, and having more investment ploughed into it by the day.

And, investment firms are taking notice.

This, is why Beauty Brands are Pretty Money right now.

According to a recent report from Nielsen, 96% of traditional beauty retail channels (meaning brick-and-mortar options) are controlled by the top 20 cosmetics manufacturers. But, on the contrary to this, 86% of e-commerce channels are controlled by companies outside the top 20.

What does this mean?

Opportunity for the space is ripe.

Smaller beauty e-commerce brands (mostly online only) are dominating the online marketplace for direct-to-consumer sales. And now, we see that outside investors are dipping their toes into this sea of new waves.

In 2018 alone, US-based companies in this beauty sector raised a record amount of funding, and 2019 is set to produce another record breaker.

The total of $900 million was the figure for the year, with 2017 being $634 million.

That’s almost 30% increase in investment.

So, why are cash rich investors swooping in on beauty companies specifically? It’s partly because businesses that specialize in cosmetics and other personal care products are getting good at using technology to sell their products. They are also at the forefront of where the world is; social media.

Beauty brands that perform well, are performing well because they KNOW the online landscape and have used it to their total advantage.

Because, if they didn’t, they wouldn’t exist.

These ‘small’ online only brands are the new ‘go to’ for investors for this reason. They are innovative, forward thinking, always producing new content to beat the rest and stand out, and have a strong understanding of the online ecosystem which is the foundation for commerce going into 2020 and beyond.

As an example of a big hitter, we may want to look at Glossier.

Glossier for instance, launched its makeup on Instagram before it even had its website.

The brand founder Emily Weiss said at TechCrunch Disrupt in 2018 that more than 70% of millennials purchase beauty and fashion products through Instagram. We personally believe this will be 80-90% within the next 24 months.

YouTube, and anything video related such as IGTV is also a major platform for beauty brands. An average of more than 1 million beauty videos are viewed on the video site every single day, according to a BBC report. That’s up from averages of 800,000 per day last year and about 500,000 in 2016.

A separate conclusion for why private investors and investment firms alike are into beauty companies right now is that they’re paying attention to what customers want, and how they want it.

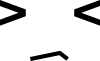

Beauty consumers are increasingly drawn toward personalised beauty products, including those that offer a variety of shades for a diverse customer base. In early 2017, Shiseido bought MatchCo, a venture-backed startup that makes customisation software meant to help users find products that match their skin. Mented Cosmetics specializes in makeup made for darker skin tones. And singer Rihanna is the founder of Fenty Beauty, which provides foundations meant to work with all skin tones around the world.

Personalisation is key in this new world when it comes to just about anything, and the beauty niche is definitely paving the way for this future.

Myles Broom

The Normal Company