The Normal Company is thrilled to announce a partnership with The Hut Group (THG), and their word-class tech and e-commerce infrastructure that powers their brands, and also supercharges other retailers looking for global growth, at speed.

Best in class for tech, infrastructure, fulfilment and operations at scale, THG is the brand owner of considerable e-commerce giants such as MyProtein, Illamasqua and ESPA, online marketplace owner for the likes of Lookfantastic and Coggles, and has long term e-commerce centric partnerships with Coca-Cola, Hotel Chocolat, and Nuxe to name just a few.

A considerable partnership for The Normal Company, allowing THG’s Digital Strategy and portfolio of brands to have access to The Normal Company for end to end paid advertising, and fully managed digital solutions when it comes to our media buying capabilities which include primarily Facebook, Google and TikTok Advertising strategies and fully managed execution for e-commerce brands.

With our performance marketing expertise, and the vast demand for such expertise from The Hut Group’s brands, marketplaces and partners, it has made for a natural synergy between entities, to assist and manage the end-to-end servicing for clients with paid advertising.

Additionally, our clients now have direct access through this partnership to a world class fulfilment partner. Logistical support, warehousing scale, top tier e-commerce platform builds fully backed and managed by THG.

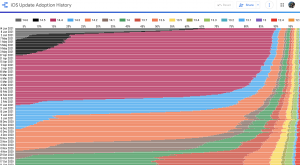

THG Ingenuity is the end-to-end platform that The Hut Group has built in order to service their own 80 brands and marketplaces, as well as long-term partners depicted below.

The premise is simple; by bringing absolutely everything in house within THG, it cuts costs and lead times, thus making everything easier for brands who are serious about mass scale, and best in class fulfilment to get to the next level.

Regardless of what a brand needs, the THG Ingenuity structure allows brands to get it right, with the very best.

With 16 years of global direct-to-consumer expertise, driven from proprietary tech, operations, brands and data, THG has the solution that eliminates all disproportionately expensive third-party technology providers, and seamlessly allows for the integration of everything needed end to end. Now, THG is the partner of choice for the world’s leading brands and those looking to grow at a global scale.

Having scaled THG’s own brands into global market leaders who drive over $2bn of annual sales, THG Ingenuity as a service and platform, is the proven peer-to-peer service provider able to solve business growth challenges and growth ceilings brands fall victim to at both a global and local level.

We are extremely excited to officially be working with THG, and integrating our expertise at The Normal Company with theirs, to assist one another with brand growth on an all encompassing format.

![]()